Keep calm and invest.

We know what your money needs

Diversify your Portfolio with Peer-to-Peer

Most risk analysts would agree that diversifying your assets is one of the most effective ways to lower risk while reaching your long-term financial goal. Diversify with one of the Philippines’ leading Peer-to-Peer platforms, Blend.ph, and earn as much as 30% per annum.

As with any investment, you are prone to having risks of default borrowers. But don’t worry! Blend.ph’s platform provides you with the necessary tools and services to lower those risks.

₱5,000

Minimum Investment

6%-30% per annum

Interest

6 Loan Products

Diversify your portfolio

Minimizing your Risk

Peer-to-Peer’s target market is the population that has limited access to financial services and unbanked individuals, these types of loan inherently come with risks for investors. However, unlike other platforms, Blend.ph offers its investors the right tools and services to curb the risk as you invest with us.

Listed below are the services and strategies that Blend.ph caters our investors to ensure their assets work for them.

Risk Acceptance Criteria

Blend.ph, together with third party credit bureaus, asses the capability of the borrowers to pay the loan in full. Blend.ph’s team works tirelessly in updating their RAC to be as accurate and precise as possible in determining High risk, Medium risk, and Low-risk borrowers.

Learn More

Borrower Verification

Blend.ph takes pride in its strict KYC (know your client) guidelines to verify the identity, suitability, and risk of engaging transactions with a borrower. This is done to control the risk of fraud and risk of default our investors might experience.

Learn More

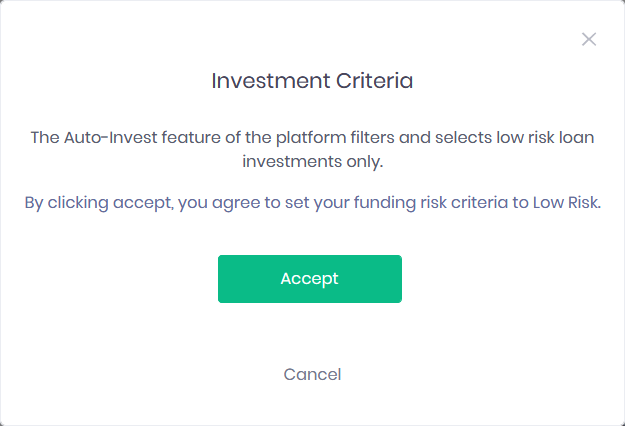

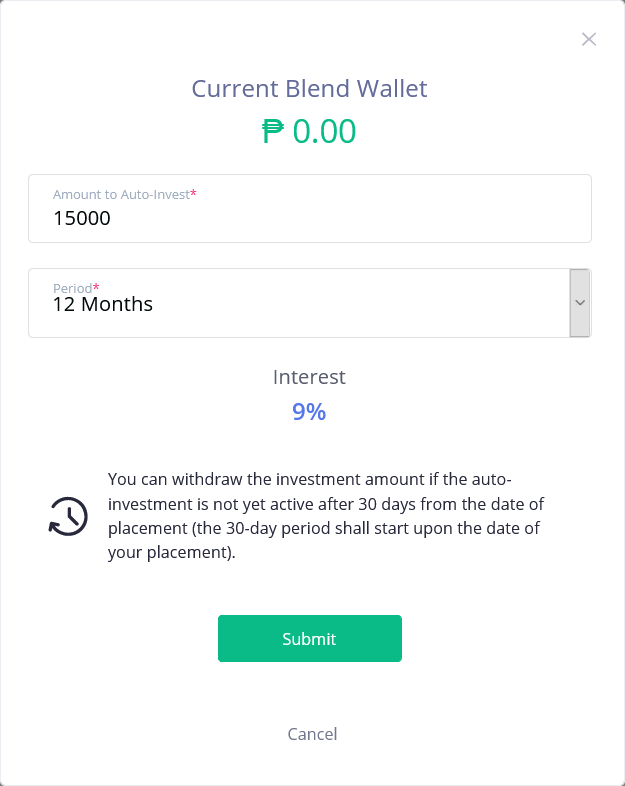

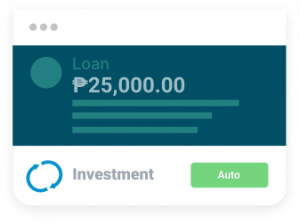

Auto-Invest

Blend.ph developed a new Investor Arrangement called Auto-invest. Blend.ph’s Auto Invest gives our investors the opportunity to reach their financial goal and financial wellness while eliminating all the risk our investors may experience. Auto-investing with Blend.ph will give you a secure and risk-free 9% interest of your capital investment per year.

Learn More

Legal Assistance

If the borrower would not pay the monthly repayments, Blend.ph will also provide legal assistance to our investors and exercise all necessary legal actions to hold the borrower accountable.

Learn More

Risk Acceptance Criteria

Blend.ph, together with third party credit bureaus, asses the capability of the borrowers to pay the loan in full. Blend.ph’s team works tirelessly in updating their RAC to be as accurate and precise as possible in determining High risk, Medium risk, and Low-risk borrowers.

Learn More

Borrower Verification

Blend.ph takes pride in its strict KYC (know your client) guidelines to verify the identity, suitability, and risk of engaging transactions with a borrower. This is done to control the risk of fraud and risk of default our investors might experience.

Learn More

Auto-Invest

Blend.ph developed a new Investor Arrangement called Auto-invest. Blend.ph’s Auto Invest gives our investors the opportunity to reach their financial goal and financial wellness while eliminating all the risk our investors may experience. Auto-investing with Blend.ph will give you a secure and risk-free 9% interest of your capital investment per year.

Learn More

Legal Assistance

If the borrower would not pay the monthly repayments, Blend.ph will also provide legal assistance to our investors and exercise all necessary legal actions to hold the borrower accountable.

Learn More

Invest and Lend

How to be an investor and how to earn.

CREATE YOUR ACCOUNT

Step 1

Fill in the online form and upload clear copies of two (2) valid

IDs (primary government-issued IDs).

Upon approval of your account, you will receive detailed instruction on how to fund your Blend.ph wallet.

(Note: You can also check funding wallet process below. Don’t forget to verify your Email)

FUND A LOAN

Step 2

After funding your BLEND wallet, you may start placing fund on loan

applications. Certain information, such as risk grades, are disclosed to you as a guide

to your decision-making.

EARN MONTHLY INTEREST

Step 3

Loan repayments are scheduled monthly, but you may withdraw the funds you’ve earned on your BLEND wallet anytime.

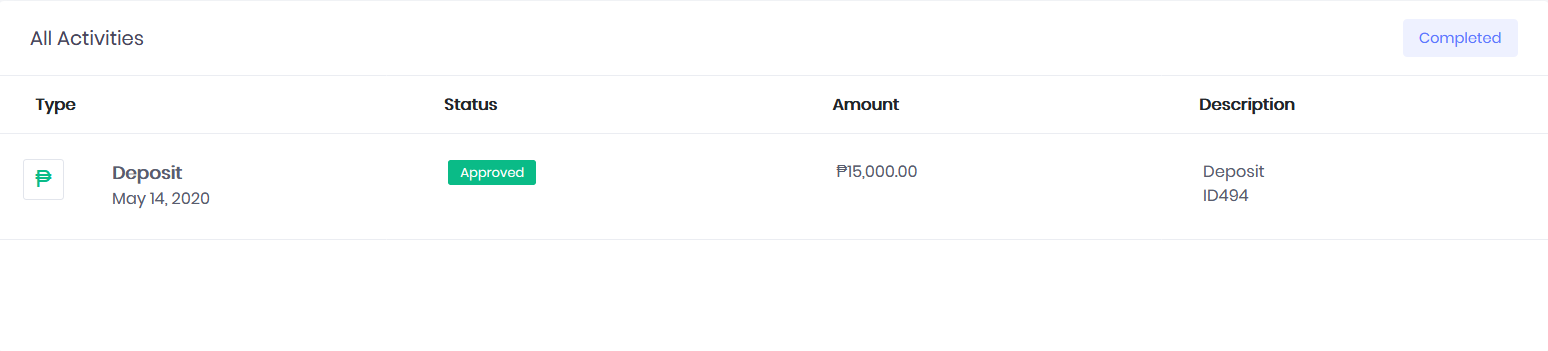

How to fund your Blend Wallet?

Peer-to-Peer funding allows you to gain profit through loan funding. However, to fund a loan application, funding your wallet must first be done. Once you deposit your initial investment, it will be immediately credited to your Blend Wallet. Now, you can start your peer-to-peer lending journey with Blend.PH.

PEER-TO-PEER

Peer-to-Peer investments offers up to 30% profit from your initial investment through online loan funding on Blend.PH platform. With this, you can generate income while at rest or even when you are on-the-go.

AUTO-INVEST

Blend.PH Auto-Invest feature offers you a secured earning through your higher-than-usual investment interest. Blend.ph’s Auto Invest gives our investors the opportunity to reach their financial goal and financial wellness while eliminating all the risk our investors may experience. Auto-investing with Blend.ph will give you a secure and risk-free 9% interest of your capital investment per year.

Investor Videos

FAQs

How to fund BlendPH Wallet?

Using Mobile (Through Paynamics)

Step 1: Log in to your BlendPH account.

Step 2: On your dashboard, click the “Add Funds” button. (Note: Make sure that your profile is complete, and your account is approved by our Investor’s Relation Officer.)

Step 3: A modal will appear after you click the “Add Funds” button. Click “Proceed with Paynamics”.

- Input amount. (Note: Minimum amount is ₱1,000.00. You will be redirected to our online payment portal to complete your transaction securely. You will be charged a convenience of ₱35.00.)

- Click the “Proceed” button. You will be redirected to Paynamics.

- The next step will depend on what payment method the user will choose.

Using Mobile (Through online banking site or mobile app)

Step 1: Log in to the online banking site or mobile app then select “Transfer Money”.

Step 2: Select “Transfer to 3rd party” and fill in the details.

Step 3: Enter BlendPH’s account number.

Step 4: Confirm the details of your transaction.

Step 5: Key in mobile key or One-Time PIN (OTP) then submit the transaction.

Step 6: Save a screenshot of the transaction receipt.

Step 7: Login to your BlendPH account.

Step 8: On your dashboard, click the “Add Funds” button. (Note: Make sure that your profile is complete and your account is approved by our Investor’s Relation Officer.)

Step 9: A modal will appear after you click the “Add Funds” button. Click “Proceed with Bank Transfer”.

- Input amount. (Note: You need 5000 Php in able for you to fund a loan.)

- Select BlendPH bank account you are depositing your funds to.

- Input the reference number of your deposit transaction.

- Attach the screenshot of your deposit transaction as proof.

- Click the “Submit” button.

- Transaction will reflect once the finance officer approves the deposit transaction.

What is the risk in investing?

All investments carry risks. Different loans carry different levels of risks depending on their risk rating (high, medium, low) and your chosen investment strategy (diversification). Loans with the highest risks also carry the highest interests while loans with the lowest risks carry the lowest interests. When considering your investment, it is important to know that levels of return from each investment may vary and the performance of your investments is not guaranteed.

Despite the rigid and thorough underwriting process, all loans carry the risk of default. You should always keep in mind that there is a chance that your investments will be lost and there is always a risk with changes in economic conditions, political instability, changes in laws, delay in payment, and fraud.

Before investing, appraise the risks that you are willing to accept considering your age, investment time frame, other investments, and risk tolerance. It is important to develop an investment strategy that best suits your personal preferences and conditions.