Investor Portfolio

Investment Arrangements

Blend.ph knows that an effective investment strategy that most investors use to lower their risk of loss is the concept of diversity. That is why, we offer two types of investor arrangements, Peer-to-Peer investment, and Auto-Investment.

Peer-to-Peer investment offers our investors a higher rate of return but has a greater risk. Investors opting to subscribe to this type of investment may gain up to 30% of their investment in a year. Auto-investment, on the other hand, offers lower risks but will only have a guaranteed 9% gain per year. Repayment of the monthly dues will start one month after the disbursement of the loan. Every month, an amount of repayment from the borrower will be added to the investor’s blend.ph wallet if the investor subscribes to Peer-to-Peer investment. If the investor subscribes to Auto-investment, every month after the disbursement of the loan, 0.75% of the investor’s principal investment would be deposited into the investor’s Blend.ph wallet.

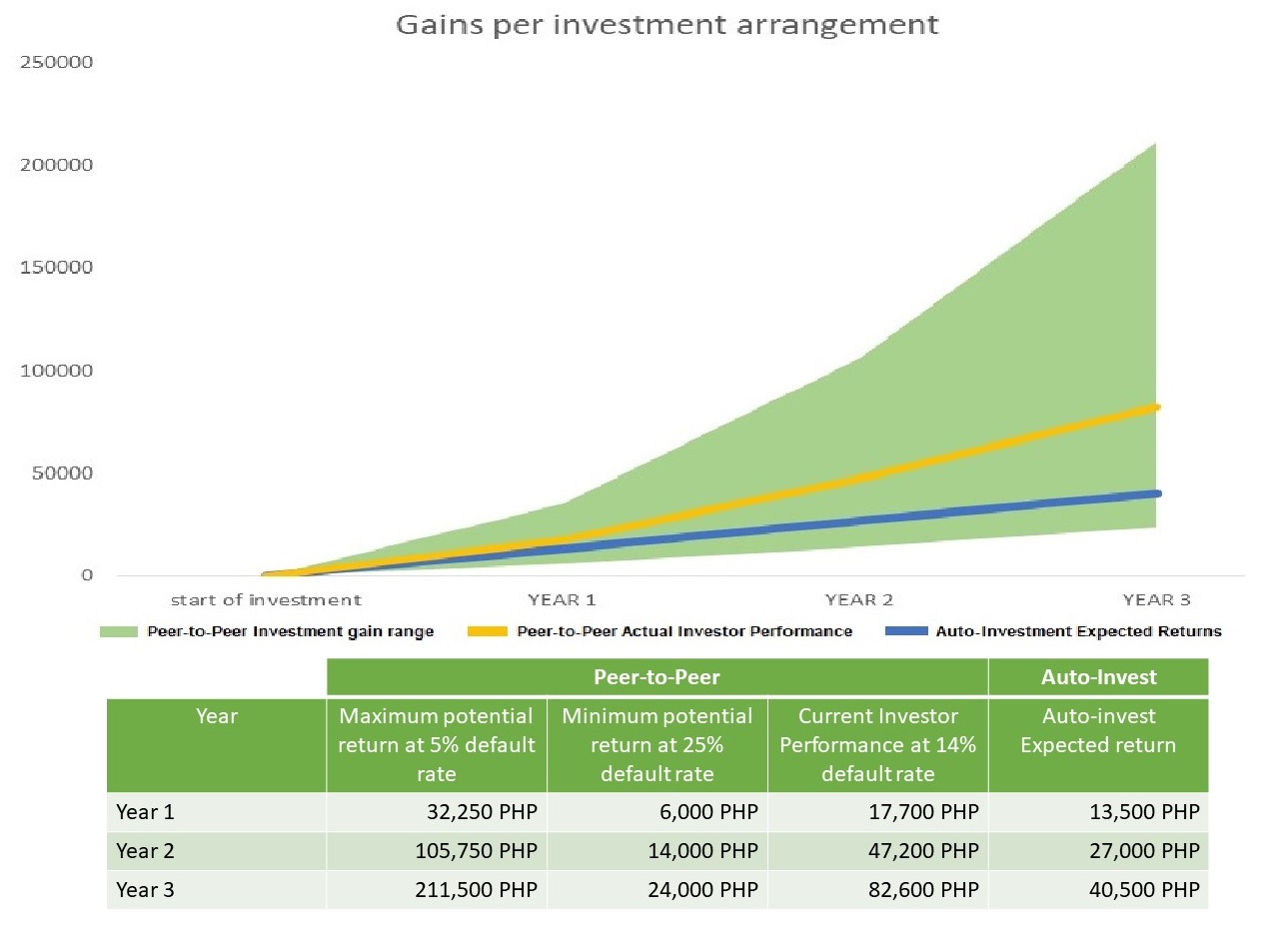

Diversifying your Blend investment will also help you eliminate the risk of loss. An investor can do this by either funding different loan applications or by investing some of their assets to Auto-investment while the remaining will be used in Peer-to-Peer investment. Refer to the table and graph below to visualize the expected yearly Return of Investment for 3 years with a starting amount of 150 000 PHP.

Investment Arrangements

Blend.ph knows that an effective investment strategy that most investors use to lower their risk of loss is the concept of diversity. That is why, we offer two types of investor arrangements, Peer-to-Peer investment, and Auto-Investment.

Peer-to-Peer investment offers our investors a higher rate of return but has a greater risk. Investors opting to subscribe to this type of investment may gain up to 30% of their investment in a year. Auto-investment, on the other hand, offers lower risks but will only have a guaranteed 9% gain per year. Repayment of the monthly dues will start one month after the disbursement of the loan. Every month, an amount of repayment from the borrower will be added to the investor’s blend.ph wallet if the investor subscribes to Peer-to-Peer investment. If the investor subscribes to Auto-investment, every month after the disbursement of the loan, 0.75% of the investor’s principal investment would be deposited into the investor’s Blend.ph wallet.

Diversifying your Blend investment will also help you eliminate the risk of loss. An investor can do this by either funding different loan applications or by investing some of their assets to Auto-investment while the remaining will be used in Peer-to-Peer investment. Refer to the table and graph below to visualize the expected yearly Return of Investment for 3 years with a starting amount of 150 000 PHP.

Understanding the Risks

Just like in any financial institution, investors may face the risk that the borrowers may not be able to pay on time or may not be able to pay at all. These cases are called Overdue borrowers and default borrowers.

Overdue borrowers are the borrowers who were not able to pay their monthly repayment on time, but there is still a possibility to collect their delayed repayments. Default borrowers, on the other hand, are borrowers that no longer maintain communication with Blend.ph and have no intention of paying their loan. In this scenario, Blend.ph exercises all necessary legal actions to hold the borrower accountable.

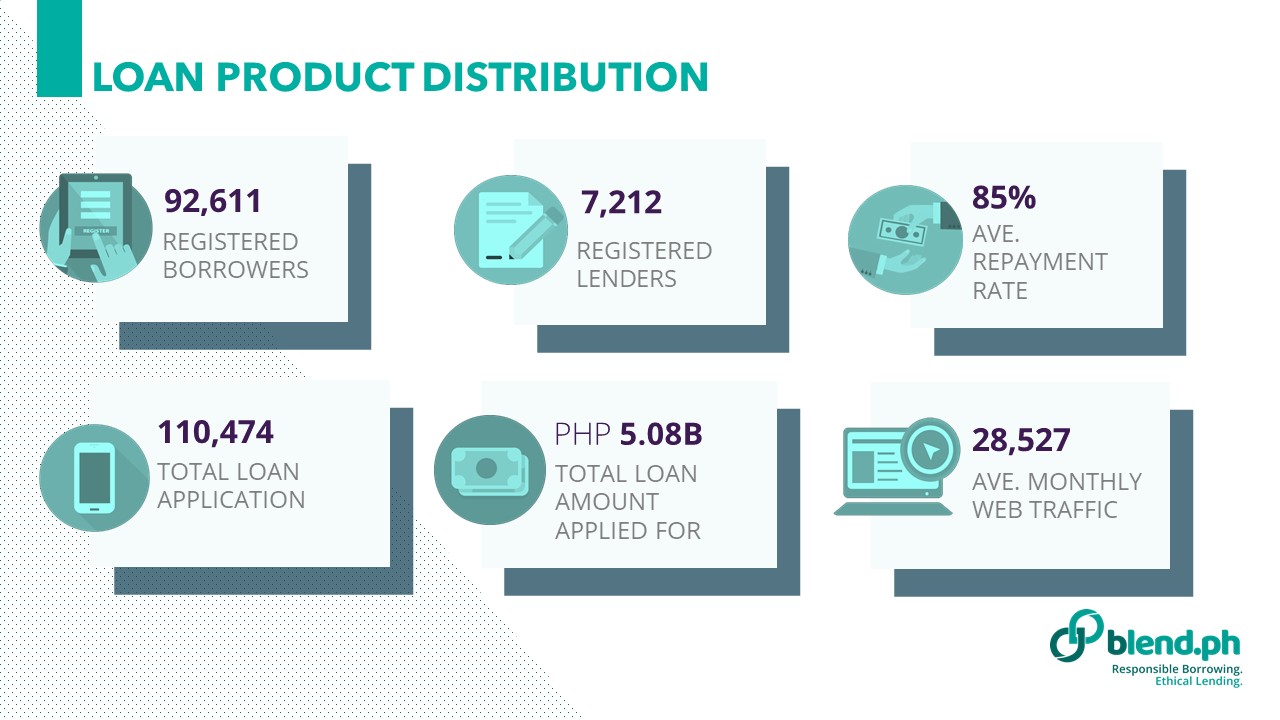

Posted below is the current performance of Blend.PH for you to better understand and manage your risk.