Why P2P Lending and Borrowing is on the Rise

More and more individuals in the Philippines are turning to peer-to-peer or person-to-person borrowing and lending. So, what is this thing exactly and why is it becoming popular? In this article, we take a look at how P2P started and how far it has become.

Personal loans without having to go through banks

Peer-to-peer borrowing and lending arrived in the Philippines not too long ago. It probably started, give or take, four to five years ago, around the time when the likes of Uber and Grab started disrupting the taxi industry and when Airbnb grew in popularity. The “sharing economy” quickly reached our shores and soon, financial start-ups aiming to connect verified borrowers to investors started operating locally.

Last year, we launched Blend PH, one of the few online markets in the country focused on two-way P2P transactions (borrowing and lending). This year, we attracted significant investments and partnerships with trusted organizations who share our aim of empowering the common Filipino financially.

The idea of taking over banks as credit sources and investment vehicles in the Philippines made great sense. The demand for instant cash, sans the lengthy processes and enormous paperwork required with traditional providers, is continuously on the rise, alongside a growing number of people looking to invest their money on worthy businesses. The power to offer an alternative to help people in their urgent monetary needs is key to Blend’s current successes.

How does P2P work and why it is such a hit in the Philippines

The local banking system is dominated by huge institutions that pay a modest amount to those who open up a savings account as a form of interest payment. Borrowers, meanwhile are charged with higher interest rates. This is how the traditional banks make money, and this system is obviously designed to benefit the banks instead of the customers.

In addition, the Philippines, despite being one of the most populous countries in the world, still remains hugely unbanked. The difficulties to transact with banks and the lack of bank branches and missing bank presence in the more rural areas both contribute to this deficiency, on top of the members of society who live below minimum wages and make the idea of banking the least of their concerns.

For those in a financial crisis, the practical solution is to borrow from family members or friends. The lenders heavily rely on basic honesty and trust to ensure that the money owed will be paid back, which, in most cases, end up poorly and lead to the dissolution of relationships.

There is however, huge internet usage in the country. What the banks couldn’t reach, the internet can. This is what makes an online financial platform like Blend fit in the grand scheme of things.

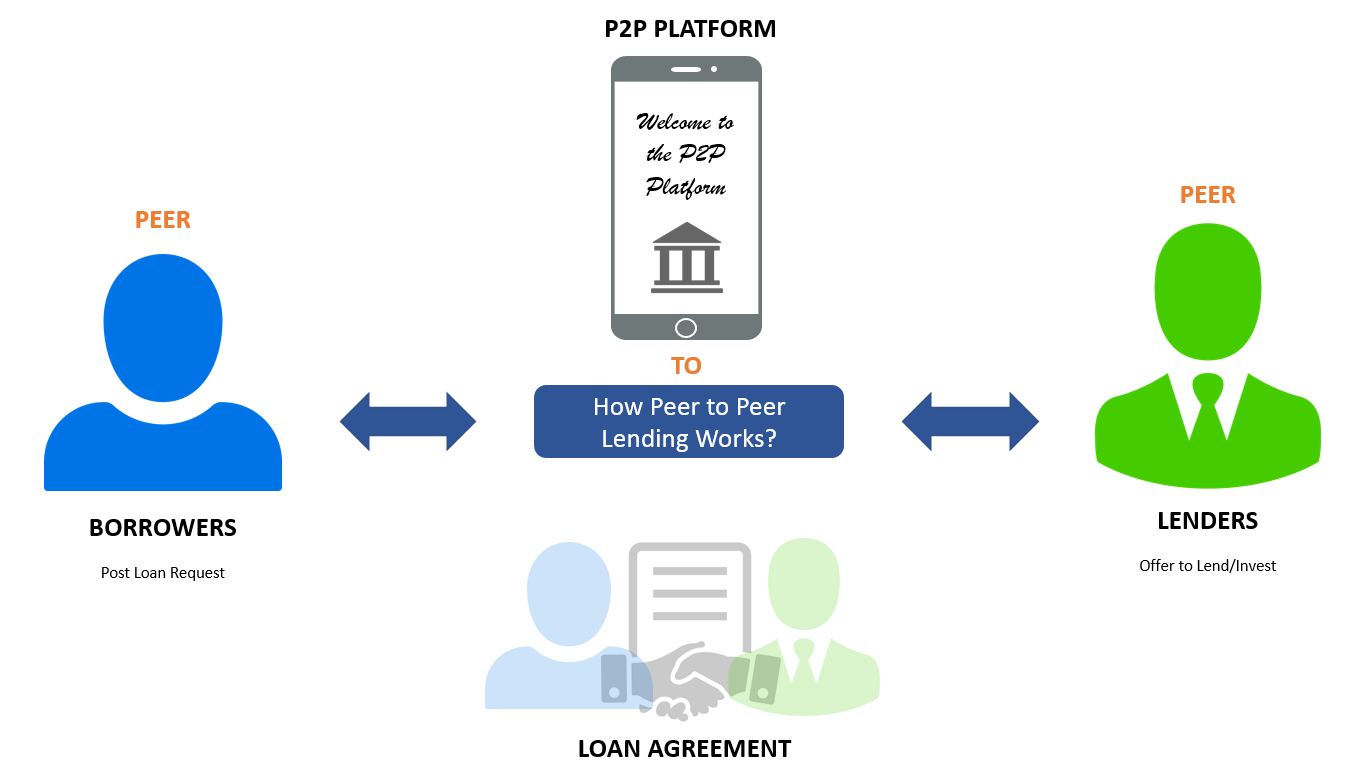

Just like Facebook, Twitter, or any other social service online, the idea of P2P is to connect people directly, cutting the banks out of the equation. Lenders can get good rates on their investments while borrowers are given the chance to choose the interest rate suitable to their capacity to pay.

Because Blend assigns a risk tag to loan applicants based on their age, employment, and credit history, borrowers are carefully screened and subjected to integrity checks. If a borrower gets assigned a higher risk tag, the investor can then get higher interest income.

And because a lender would know exactly why a loan request has been made, he can carefully select the causes or goals that he wants to fund.

Applying for a loan online is completely different when compared to transacting with a bank. From the application process, assessments, approval, interest rates, to payment terms, it definitely shows that P2P is more flexible and convenient. The same goes for investing. There’s no need for a personal appearance like most investment channels would require.

Why big banks are not too keen on P2P transactions

Banks, to this day, hold a lot of financial power. They act as middlemen between investors and borrowers. To “officially” borrow money, you would need a bank. To “officially” invest money, you’d also be dealing with a bank.

When people try to disrupt the traditional ways of transacting financially, the banks would shiver. P2P can do pretty much the same thing, which is to connect investors and borrowers safely and securely. And that’s without the tightly held processes and exorbitant fees often passed onto the consumers.

In the United States, brand names like Prosper and Funding Circle are gaining ground, threatening to take on big international banks. In the U.K., Zopa, another P2P marketplace, has been called the most trusted loan provider. Australia’s SocietyOne has earned backing from one of the world’s richest, Rupert Murdoch.

Here in the Philippines, Blend PH is quickly becoming the breakout P2P marketplace of choice. It’s steadily gaining huge membership numbers, growing its number of approved loans, and increasing user investments.

P2P is an ideal opportunity for both lenders and loan applicants. It offers bigger return rates when compared to placing your money in a bank. While there is a risk of defaults, it can be mitigated when you carefully examine where your money goes. For borrowers, it’s even easier. Since the application is all online, you’d immediately get the funding you need in just a matter of days provided that you have the right requirements.

If this sounds interesting to you, then it’s probably time to check out what we offer for borrowers and lenders at Blend.