Say Goodbye to Negative Cash Flow and Living From Paycheck to Paycheck

Ever wish you had no money worries, or definite about meeting future financial obligations? If poor cash flow problems tend to keep you up at night, you are not alone. Yet you can be smarter about money, and stop living paycheck to paycheck.

What does living paycheck to paycheck mean? It equates with not having some extra cash at hand nor in your e-wallet nor bank account for unanticipated events, or using up all of your monthly income to cover immediate expenses. There is nothing left behind for savings or investment. It all boils down to not having a safety net.

What can possibly be the reasons for a paycheck-to-paycheck existence? Most Americans live paycheck to paycheck, their earnings depleted and quality of life dragged down by the credit card curse, or long-term student-loan repayments, or other reasons.

With the Covid-19 pandemic, the percentage of Americans living paycheck to paycheck increased, based on personal accounts of call center agents handling student loans. In fact, last year, even with economic stimulus payments, numerous Americans had called up student loan servicers to see which repayment options they still qualified for.

A high percentage of Americans had signed up for hefty student loans, but end up suffering financially as a result. While some are able to pay off their debt in due time, others keep on renewing and accumulating accrued interests. Almost 40% of Americans with active loans have not been able to pay off other debts nor save for retirement.

An ever-increasing number of Filipinos, likewise, may be living paycheck to paycheck, yet hold the illusion that they have the means to buy what they want or need. Many of these individuals present an image of living a very comfortable, financially secure life, aided to a large extent by social media, but the money troubles persist.

The most probable reason why most people continue living paycheck to paycheck, no savings whatsoever is that they consider savings as an afterthought. Or the bills and expenses – for oneself, one’s family, and perhaps extended family – pile up high each month, there really is nothing left to `save for a rainy day.’ Hence, they commit to pay other bills using the next paycheck.

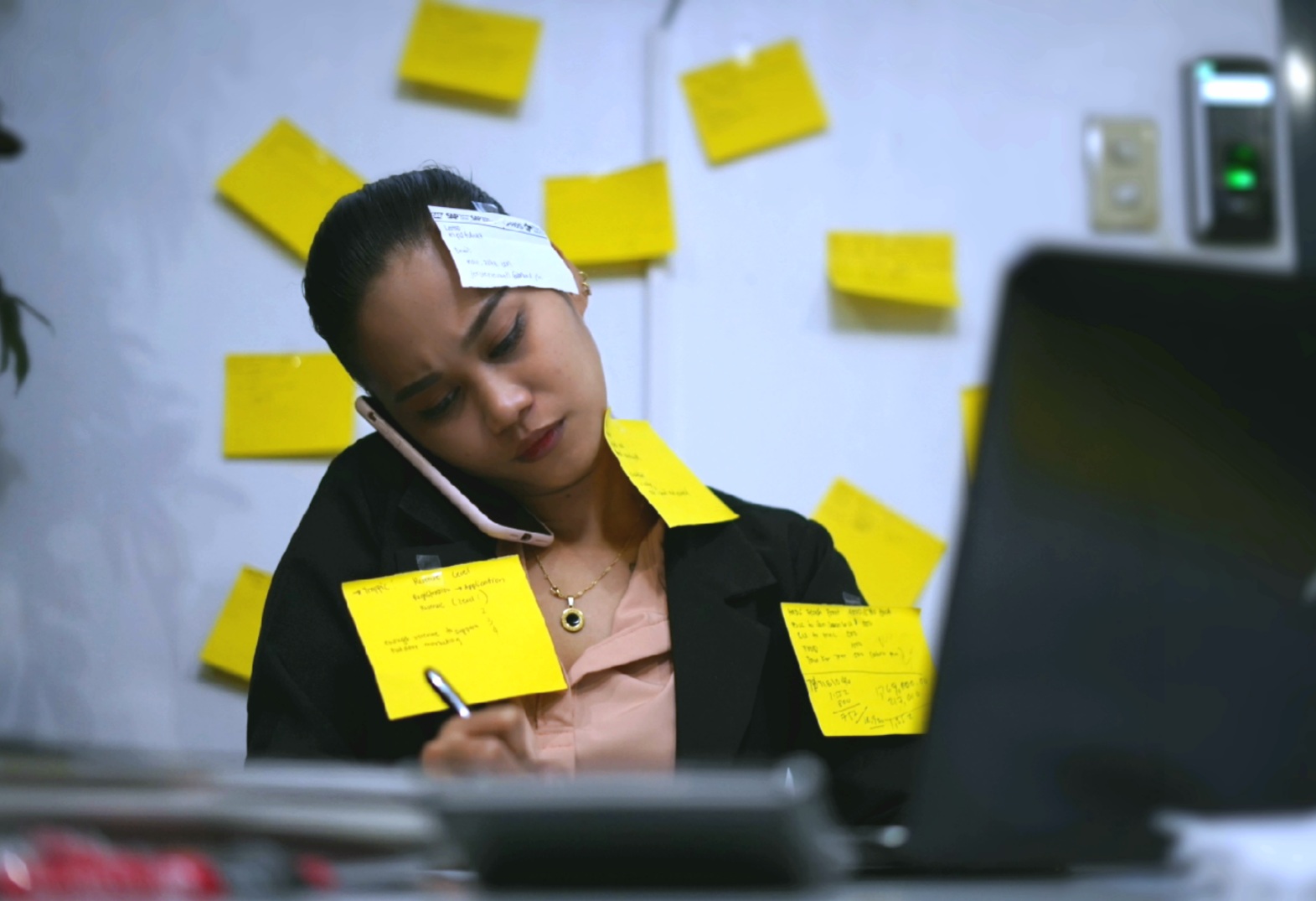

Working and living paycheck to paycheck can be tiring and to an extent, stressful. It is a sorry situation, but most employed people rationalize that payday is just around the bend, so they end up borrowing from family members, friends, or even co-workers.

In the meantime, they try to subsist on a paycheck-to-paycheck budget. If you look around you with an observant eye, people diligently working the nine-to-five grind for years, but not being able to put away enough savings, is a common occurrence.

If you are among them, step back for a moment and consider the possible reasons why you tend to run short of funds or experience `critical wallet days before payday. Perhaps you can adjust your budget in order to be more realistic when it comes to your expenses.

During the pandemic, lots of people were furloughed, or took a salary cut, and many took months before being able to bounce back. Even without a health crisis, any unexpected circumstance to dip into one’s savings can occur, and eat away at funds set aside for future plans.

Let’s face it. Many of us aspire to be able to build a stronger financial future. Yet certain life events, or things we never thought would happen – like the major Covid-19 crisis – unfold. Today, many of us are living in a continual state of financial peril, but we can have the upper hand.

How to Stop Living Paycheck to Paycheck

The key to counteracting a negative cash flow or to break the paycheck-to-paycheck cycle is to strive hard to be ready for it. If your job is not enough, or if you are supporting so many people, including young adults who can work, encourage them to find an income stream, and make your own money work for you, too.

You need not add or be part of the percentage of people living paycheck to paycheck, especially if you have a marketable skill. Many people are of the notion that if they hold a job that demands much of their time, that single job is enough. That is old-school thinking.

Finding another job that pays better or making more money will not happen overnight. Letting other people, like extended family members depend on you solely on a long-term basis may be why you are saying to yourself, “I’m broke and need money.”

You owe it to yourself to set a little for your own needs. You may be wondering what the “pay yourself first” definition is? Among the first few important things you can do whenever you receive your paycheck is to allot a portion of it for a reliable investment vehicle.

Getting into a popular investment that you know nothing about, such as cryptocurrency, may not turn out to be a good move. To buckle down to learning how to pay off debt when living paycheck to paycheck, have a financial plan in place, and stick to the financial plan.

Avoiding relying too much on credit cards will also be good. For those already saddled with credit card debt, it may be time to speak with the collections department representative for an easy-to-handle payment plan. You can opt for debt consolidation, and also learn how to budget when you’re broke.

For individuals who do have some money sitting idly in a low-interest savings account, consider turning things around and choosing alternative investments such as what a peer-to-peer (P2P) funding platform like Blend.ph may offer.

The P2P platform’s Auto-Investing offers a secure and risk-free nine percent interest of one’s capital investment per year. Indeed, you can explore myriad ways on how to save money when you live paycheck to paycheck.

Getting Back on Track With Your Finances

Read and research on legitimate ways of bringing in multiple income streams. You may even consider an affordable business franchise that you can combine with your day job in the near future. Even borrowing can be part of your financial plan, for as long as you can responsibly factor in details like repayment dates and source of funds.

In the meantime, you need to stay on track with your budgeting and spending. If the income from your current job simply does not suffice, you may consider side hustle ideas that do not require a huge initial investment. Rental properties, online tutoring, van rental, part-time gigs like teaching music, or alternative investment vehicles like P2P lending or business lending can bring in income streams.

Ask yourself, “why do you live?” It is not to work and work until you die, and have none to show for all those years of hard work, right? The sooner you devise a way to come up with an investment strategy or passive income, the sooner you can be in a much better financial state.

Always keep in mind that you can make better financial choices that can help you stop living paycheck-to-paycheck. You can look at your finances from a safer, more focused setting, sans the anxieties that can affect your overall well-being. Do not wait until something threatens your financial state, before doing something about it. For alternative investment avenues or `a better way to invest, Visit www.blend.ph/auto-invest to learn more.

Budgeting in your 20s: 8 Best Money Advice That You Should Take Note

You only live once. The best time to enjoy your youth is at the ripe age of 20. Today is the...

Four Sisters Partners with BlendPH for More Accessible Franchise Loans

Four Sisters Frozen Goods partners with BlendPH, an online loan agency, to offer franchisees and...

How to pay off debt in 2022

Managing debts, whether in small or large quantities, is difficult. It is a burden that others try...

How to start a business with no money – 5 easy steps

Launch Your Business With the growth and propagation of continuously competing enterprises, it has...

How to Improve Credit Score: 7 Easy Ways

SUMMARY: There are many ways how to improve credit score. The first is knowing your credit and...

Expanding a business expert, JGH Business Consultancy, partners with BlendPH

Expanding a business is something that most entrepreneurs aspire to do. There are also many...