Choose The Best Investment Option For You: P2P or Auto Invest

Working professionals render service and get compensated in the form of salaries. They are putting effort and a significant amount of time to earn money. Likewise, entrepreneurs invest their money to venture into business and expect profits as a result of operations. Indeed, people have different ways to derive gains out of invested capital or labor.

Similarly, investors also have the same goal – to generate income. But instead of working day and night shifts, investors let their money work for them. They can stay at home and monitor the investment’s progress using technological advances such as phones and laptops. It’s fast and easy, even for a first-timer.

You can build your wealth because investments handsomely pay off. If you are contemplating whether you should save or invest, saving is indeed a great idea. But investing is way much better. Investing allows you to beat inflation. On the other hand, saving cannot prevent your money from slowly losing its value due to inflation.

The good thing is, investing is not intended just for a certain group of professionals. Anyone can be an investor. An employee, businessman, freelancer, and literally anyone can invest and grab the opportunity to earn passive income regardless of vocation.

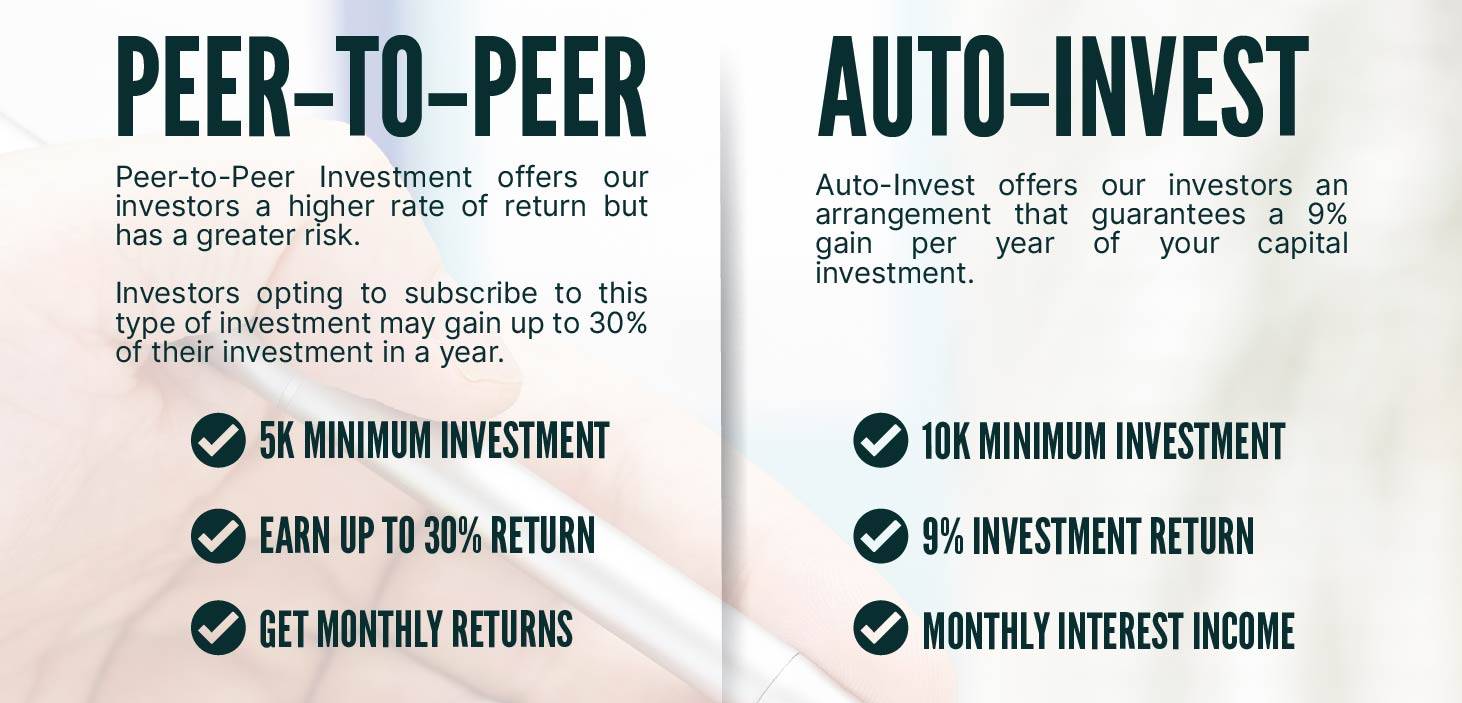

Moreover, people can choose from a variety of choices when it comes to investments. But let’s look at these two alternatives, which are emerging as the best options in today’s economy.

What Is P2P Investment?

Peer-to-peer lending, also known as P2P, is a form of lending without involving intermediary financial institutions in the transactions. Borrowers and lenders directly transact with each other through online platforms or websites.

P2P pools money from a group of investors and uses it to fund loans of qualified borrowers. This process is also called crowdfunding, where investors lend money for profit.

The money being invested will earn interest over a while. And P2P lenders may choose to reinvest the money or withdraw the same from the platform. To maximize returns, most investors choose to reinvest the money.

Pros of P2P Investment

- Diversification

Each form of investment has corresponding risks. But a good investor would know how to manage these risks. In P2P investment, lenders can minimize the loss that they may incur through diversification.

As an investor, you can diversify your investment by splitting your money between a small number of loans. In case of default of one loan, you’re not entirely losing the investment. Losses are still shouldered fairly by other notes.

- Higher rates of interest

Rates can range between 6% and 36% on different platforms. In some cases, platforms may allow investors to select the rate they wish to receive. Besides, having different investments within the same class of asset will possibly result in more returns.

- Easy to invest

The process of investing in P2P is easy to understand. Likewise, putting your money on the platform to start investing is simple. Transactions are generally done online so that necessary documents can be conveniently sent from one to another through emails.

- Transparency

Borrowers will provide financial information that can help you decide if you are willing to lend your money to them. Good credit history means lower interest loans, and bad credit, of course, will give you higher rates of return. By having enough details about the borrower’s financial situation, a lender can make informed decisions.

What Is Auto Investment?

Auto investments are ideal for those busy people who don’t have time to evaluate and approve every borrower’s application manually. P2P investment has this feature to make things much easier where you can choose to automatically reinvest your earned interest if a borrower’s profile meets certain criteria.

Practically, auto-invest saves you a lot of time. Once your account has available cash, the platform looks for qualified borrowers and then approves the loan application.

Parameters that have to be considered include interest rates, loan term, credit score, type of loan, and a lot more.

Pros of Auto Invest

- Time-saving

Since you no longer have to spend time and sift through the loan applications, you can save your time and do other tasks instead. In that case, you expect that your money works for you and gives you more benefits without taking much of your time.

- Capital keeps growing

You automatically account for your interest as part of another investment within the same class of asset. Therefore, you continually produce a steadily-growing income. It grows over time, and you don’t even need to make more deposits. If you think the investment runs pretty well already, then your investment will not deplete.

- Hassle-free investing

The system does the work by choosing the right project for your available money. Hence, you can just relax because the system manages your portfolio. You don’t need to sacrifice your valuable time to research and monitor the investment from time to time.

Be A Diversified Investor with Blend.ph!

Both investments are giving considerably high returns. They are almost similar to each other. If you can notice, the only major difference between the two is how income earned will be reinvested in the platform.

If you invest in peer-to-peer lending, borrowers who have bad credit scores still get loans but with higher rates of interest to pay. The risks are evidently higher in P2P than auto-invest, where the borrower’s credibility is significantly considered. Thus, P2P lending returns are expected to be higher because of the number of risks present in the investment.

Meanwhile, by setting parameters, auto-invest will only provide loans to the most qualified ones. Interest rates will then be lower compared to P2P lending’s rate.

If you’re planning to be a focused investor, the best move would be to allot funds for both. As you diversify your portfolio, you open your doors to the best of both worlds. To make it easier for you, here is a platform that will allow you to play both games. With Blend.ph, you can create an investor account where you can fund both P2P investment and auto invest.