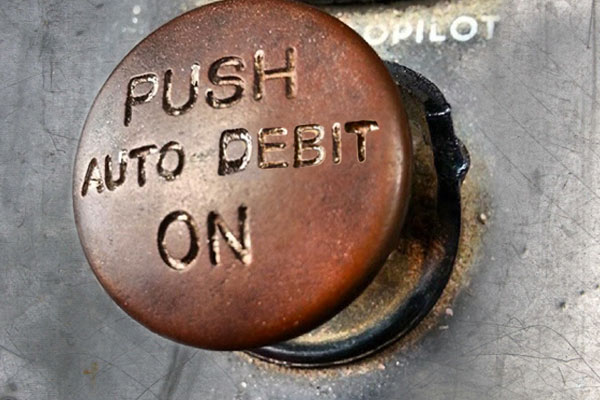

Setting Up Auto-Debit for Your Chosen Mode of Payment for Loans on Blend PH

Applying for a loan and repaying a loan on Blend PH is always a breeze, thanks to various disbursement channels and the multiple modes of payment offered to borrowers on the platform. It is now even loads easier because we’ve set up the option to enable direct debits when making repayments.

By setting up auto-debiting on your repayment channel, you are giving Blend PH the authority to take regular payments from your account automatically so that you don’t have to think about when and how much to pay when your due date comes.

Automatic debiting or automatic payments are perfect for paying fixed amounts regularly such as your rent, mobile phone plan, utility bills, credit cards, and loans – such as the one you applied for at Blend PH.

Modes of payment on Blend PH

· Checking account. A checking account from an authorized bank which you will use to issue checks for your loan repayment. Make sure that your checking account has enough funds come your repayment date to avoid running into problems.

· Authority to deduct on your payroll account. This only applies to Banco de Oro or BDO account holders. This allows Blend PH to set off the payment schedule of the borrower against the receivables on his or her payroll account. Watch this space for future announcements on affiliated banks.

· Salary deduction. An amount that the employer is authorized to take out of the borrower’s salary to pay off the money owed.

- You don’t need to open a new bank account. Because your checking account and payroll account already exists, you don’t need to go through the lengthy process of opening a new bank account just to repay your loans.

- No need to keep a maintaining balance. Because you won’t be required to open up a new bank account, you don’t have to keep a maintaining balance (other than the ones you already maintain). You also don’t need to worry about account dormancy, and neither should you worry about deductions for holding an account below the maintaining balance.

- You don’t need the approval of your HR for setting up automatic deductions. Because the transactions happen between your bank and Blend PH, there’s no need to go through your employer when setting up your repayments. This way, you’ll have full control over how you handle your dues.

- No need to queue in your bank. Remember that time when you used to line up at the bank and you’re still 10 customers away from the counter when it’s only 10 minutes until closing time? With today’s online banking technologies, you eliminate the stress involving over-the-counter transactions.

- You avoid late payments. This is perhaps the single most important bit about setting up deductions on your bank account automatically to pay for your Blend PH loans. Because it’s on auto-debit, you only have to think about having the right amount of money on your account come repayment time so that you can fully cover your dues.